The tax pros are what make SDIRAs attractive For lots of. An SDIRA is often each common or Roth - the account type you decide on will count largely on your investment and tax system. Test with your economical advisor or tax advisor in case you’re Doubtful that's best for yourself.

As an investor, having said that, your options are usually not limited to stocks and bonds if you decide on to self-direct your retirement accounts. That’s why an SDIRA can completely transform your portfolio.

Have the liberty to take a position in Pretty much any kind of asset which has a chance profile that fits your investment system; which includes assets that have the likely for a better rate of return.

Transferring cash from just one style of account to another form of account, such as transferring funds from a 401(k) to a standard IRA.

Opening an SDIRA can give you use of investments Typically unavailable via a financial institution or brokerage firm. In this article’s how to begin:

Criminals occasionally prey on SDIRA holders; encouraging them to open accounts for the objective of creating fraudulent investments. They generally idiot traders by telling them that Should the investment is approved by a self-directed IRA custodian, it must be reputable, which isn’t legitimate. Once again, Be sure to do thorough homework on all investments you end up picking.

The principle SDIRA guidelines within the IRS that investors have to have to be aware of are investment limitations, disqualified people, and prohibited transactions. Account holders should abide by SDIRA policies and polices as a way to protect the tax-advantaged position in their account.

Feel your Mate may be starting up the subsequent Facebook or Uber? Using an SDIRA, you can invest in causes that you suspect in; and potentially enjoy greater returns.

This incorporates comprehending IRS laws, handling investments, and steering clear of prohibited transactions that can disqualify your IRA. A lack of knowledge could bring about highly-priced issues.

Therefore, they tend not to advertise self-directed IRAs, which provide the pliability to invest in the broader number of assets.

And because some SDIRAs including self-directed standard IRAs are matter to necessary bare minimum distributions (RMDs), you’ll must program ahead to make sure that you've more than enough liquidity to satisfy the rules established because of the IRS.

Entrust can guide you in getting alternative investments with your retirement cash, and administer the buying and providing of assets that are typically unavailable by way click for more info of banks and brokerage firms.

Though there are plenty of Gains linked to an SDIRA, it’s not with out its own downsides. Some of the prevalent reasons why traders don’t choose SDIRAs incorporate:

Regardless of whether Recommended Site you’re a economical advisor, investment issuer, or other economic Experienced, discover how SDIRAs could become a powerful asset to grow your online business and obtain your Specialist ambitions.

Should you’re trying to find a ‘set and forget’ investing technique, an SDIRA likely isn’t the appropriate preference. Simply because you are in overall control more than every single investment built, It can be your decision to carry out your own personal homework. Bear in mind, SDIRA custodians are usually not fiduciaries and cannot make recommendations about investments.

Homework: It can be named "self-directed" for the cause. With the SDIRA, you you could try here might be entirely responsible for thoroughly investigating and vetting investments.

In advance of opening an SDIRA, it’s crucial to weigh the likely pros and cons determined by your unique monetary targets and possibility tolerance.

Limited Liquidity: Most of the alternative assets that may be held within an SDIRA, like real estate property, non-public fairness, or precious metals, may not be very easily liquidated. This may be a concern if you might want to access money swiftly.

Larger investment options indicates it is possible to diversify your portfolio outside of shares, bonds, and mutual cash and hedge your portfolio towards marketplace fluctuations and volatility.

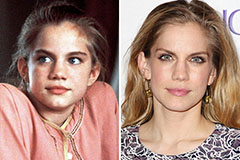

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Romeo Miller Then & Now!

Romeo Miller Then & Now! Susan Dey Then & Now!

Susan Dey Then & Now! Bo Derek Then & Now!

Bo Derek Then & Now! Nicki Minaj Then & Now!

Nicki Minaj Then & Now!